Google Nano Banana AI: The Promise and the Peril

The power of Nano Banana to create realistic images also carries the risk of misuse.

Table of contents:

- AI’s a Game-Changer, But Be Careful

- Why Undetectable AI Images Are a Big Deal

- AI Companions and Emotional Risks

- Solving the Problem: Can We Have It All?

- Wrapping It Up: Don’t Let the Banana Slip

AI’s a Game-Changer, But Be Careful

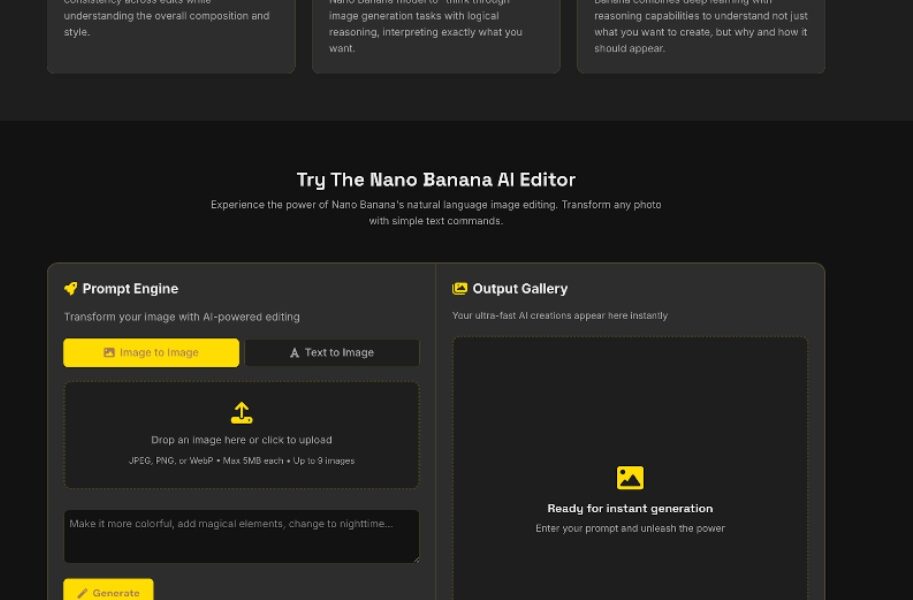

Google Nano Banana AI’s got everyone talking. Creators love it. Investors can’t stop talking about its ‘moat.’ This thing is a beast for making images — fast, sharp, and… scarily real. A photo is worth 1,000 words — but hey — add a description if you want. Sounds dope, right? Here’s the flip side, though: This tech is so good, it’s a little bit scary. No obvious ‘AI-made’ label on these images? That’s a problem. It’s as if you’re giving someone a paintbrush that can create a masterpiece — or a fake ID. So, how can we preserve the cool stuff while avoiding the chaos? That’s the million-dollar question.

Why Undetectable AI Images Are a Big Deal

No Watermark, No Clue

A watermark is standard on most AI tools. Most. You know, a little “Made by AI” tag. Not Nano Banana. Though. Its pictures seem so, well, real — too real. You can’t always tell if it’s a legit photo or something that Google Nano Banana AI whipped together. And that is a massive problem for trust in what you see online. If any old hack can produce a pro-level image with no indication that it’s a fake, what’s to prevent scams or liars? FYI, that’s not just a tech glitch — it’s a trust-killer for the internet.

Real-Life Messes from AI Misuse

Some AI has already been used to do some shady things. Things could get worse: with its powerful capabilities, Nano Banana could be used to do some serious damage. Here’s what’s out there:

- Defamation & Harassment: People have already created AI-generated fake nudes — a kind of digital yellow journalism — to bully or blackmail people. It’s easier without watermarks, thanks to Google’s Nano Banana AI. Now imagine someone faking your embarrassing photo. There’s nothing to prove it isn’t real at first glance.

- Financial Scams: AI can generate fraudulent product shots or fake celebrity endorsement ads. For example, a fake endorsement from a celebrity promoting some dodgy gadget. Vulnerable individuals, such as the elderly, might not recognize the trick. And that, dear reader, is the dangerous thing about clean images like Nano Banana’s — makes these cons look legit.

- Identity Theft: Fake IDs, passports, or other official documents? AI can do that. The ability of Google’s Nano Banana AI to produce perfect images means criminals could bypass security checks. No watermark, no easy way to quickly tag fakes.

These aren’t hypotheticals. Cases are popping up. In 2024, a scam ring used AI generated ads to con people into buying fake tech gear. Losses hit millions. Nano Banana’s lack of a clear identifier could cause a wave of this kind of fraud.

AI Companions and Emotional Risks

It’s not just that this scam is artificial. AI is getting personal. Enter the miniature AI. At the very least, they’re a thing, like virtual friends or partners. They talk to people, they share things, they even get close IRL. Google Nano Banana AI makes it possible to create super-realistic images of these companions. Cool, right? But there’s a rub: someone could use it to create phony images of your AI sidekick doing things it shouldn’t. Think emotional manipulation or catfishing, but on steroids. Those images, if they appear real and are not clearly marked, make it easy to fool someone into believing something’s messed up. The distinction between fun and fraud fades quickly.

Solving the Problem: Can We Have It All?

Google’s Tough Spot

Google’s in a pickle. They made Nano Banana (which is user-friendly and powerful). Creatives love it for things like rapidly redoing rooms or mocking up ads in seconds. But power’s a double-edged sword. Google Nano Banana AI can make images of things don’t exist — a huge/scary/OMG problem. They could insert unseen digital watermarks — sort of like… a secret code that only technology can decipher — still horrible. Or perhaps even create tools to detect AI created stuff. The issue is, those solutions could potentially slow things down or make them less fun to use. Google’s gotta juggle the wow factor with safety and all.

Users and Platforms Gotta Step Up

Imagining bad things happening to your favorite social media star? It’s not all on Google. You need to be smart about how to use AI公仔. Don’t be creating phony stuff just to screw with people. Platforms such as social media or online stores have a job, too. They need to invest in tech to sniff out AI-generated images, whether watermarked or not. Some platforms already do flag suspicious content, but the reception is mixed. If there’s a marketplace out there that cannot tell a Nano Banana-made shot of a product from the real thing, the scam wins. Everyone’s gotta do their part to keep the internet legit.

Time for Rules

Tech moves fast. Laws? Well — not so much eww. Google’s Nano Banana AI’s out here straight up altering the game, but there ain’t no handbook for navigating its risks. We/Users need laws to curb AI enabled fraud by, say, fake IDs or deepfakes. Watermarking should be the rule — not the plain exception. Perhaps even mandate that platforms label AI generated content. Some countries are beginning to talk about this — Europe’s got draft laws on AI transparency — but it’s slow. Unrestrained, the downside of Nano Banana could outweigh the good.

Wrapping It Up: Don’t Let the Banana Slip

Google Nano Banana AI is a game changer. It’s got creators excited, businesses saving money and investors salivating. But its ability to produce invisible images should set off alarm bells. No watermark also means fakes can pass through — whether it’s scams, harassment or worse. By bringing in miniatur AI as well, fake images could be able to hurt people where it matters to them emotionally. Google’s gotta find a way to keep Nano Banana dope without letting it become an instrument of chaos. Platforms and users must stay vigilant and lawmakers must play catch-up. The future of AI is bright, but not if we don’t prioritize safety along with all that cool stuff. Can we do it? That’s the challenge.

Media Info:

Contact Person: Ava NanoBanana

Organization: Nano Banana Inc.

Email: ava@banananano.ai

Website: banananano.ai

Country: United States